The Union Budget 2026 isn’t loud, flashy, or dramatic—and that’s exactly what makes it interesting. Instead of headline-grabbing tax rate cuts or sudden hikes, Budget 2026 focuses on fine-tuning the system, tightening compliance, and simplifying processes. Think of it like servicing a car rather than buying a new one. The engine stays the same, but performance improves.

This budget aims to balance fiscal discipline with taxpayer convenience, while quietly encouraging transparency, digital compliance, and global competitiveness.

Overall Economic Vision of Budget 2026

Budget 2026 clearly signals stability. The government’s approach revolves around:

-

Broadening the tax base instead of increasing tax rates

-

Improving ease of compliance

-

Encouraging foreign investment

-

Strengthening GST administration

-

Rewarding honest taxpayers

Rather than shocking the system, the Finance Minister chose predictability—and markets love predictability.

Direct Tax Changes

Overview of Direct Tax Reforms in Budget 2026

Direct tax reforms in Budget 2026 are all about process, timelines, and clarity. The government seems to say: “We trust you, but we also want clean paperwork.” From extending due dates to refining TDS and TCS provisions, the focus is clearly on smoother tax administration.

Key Income Tax Changes in Budget 2026

Let’s break down the most important income tax changes—one by one.

Extension of Due Date for Non-Audit Taxpayers

Good news for salaried individuals and small professionals. The due date for filing Income Tax Returns (ITR) for non-audit taxpayers has been extended. This change recognizes the real-world challenges taxpayers face while collecting documents and reconciling data.

Why it matters:

Less panic. Fewer penalties. Better compliance.

Extension of Revised Return Due Date

Earlier, if you missed correcting a mistake, you were racing against time. Budget 2026 extends the revised return filing window, giving taxpayers more breathing room to fix genuine errors.

In simple terms:

Mistakes happen. Now you have more time to correct them without fear.

Taxation of Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) finally get clarity. Budget 2026 rationalizes their taxation, especially on premature redemption and secondary transfers.

Impact:

-

Clearer tax treatment

-

Better planning for long-term investors

-

Reduced ambiguity during assessments

Gold just became a little less confusing.

TCS Rate Changes

Tax Collected at Source (TCS) has been fine-tuned. Some rates have been rationalized to reduce cash-flow pressure, especially on high-value transactions.

Why this helps:

It improves liquidity and avoids unnecessary blocking of funds.

Form 15G and 15H Changes

Budget 2026 tightens the rules around Form 15G and 15H submissions. Enhanced reporting and digital verification aim to prevent misuse.

Translation:

Genuine senior citizens benefit. Misuse gets filtered out.

Buyback Provisions

Share buybacks now face updated tax treatment to remove loopholes and ensure parity with dividends.

Big picture:

Companies will rethink capital distribution strategies, and shareholders get clearer tax outcomes.

TDS Procedural Changes

TDS isn’t changing much in rates—but procedures are smoother. Automation, fewer mismatches, and quicker credit reflection are the real wins here.

For taxpayers:

Less chasing, fewer notices, cleaner Form 26AS.

Foreign Asset Disclosure Scheme for Small Taxpayers

This is one of the most taxpayer-friendly moves. Budget 2026 introduces a simplified disclosure scheme for small taxpayers holding foreign assets, encouraging voluntary compliance without harsh penalties.

Why it’s smart:

It builds trust instead of fear.

Tax Holiday for Non-Residents and Foreign Companies

To attract global capital, Budget 2026 introduces targeted tax holidays for specific non-residents and foreign companies operating in priority sectors.

Outcome:

India becomes more attractive as an investment destination.

STT Changes

Securities Transaction Tax (STT) sees selective rationalization, particularly in derivatives and high-frequency trading segments.

Market impact:

Improved efficiency without disturbing retail investors.

IFSC Exemptions

IFSC (International Financial Services Centre) at GIFT City continues to enjoy expanded tax exemptions.

Why it matters:

India wants to compete with Singapore and Dubai—and this is how it’s doing it.

Other Important Amendments

Other noteworthy tweaks include:

-

Simplified penalty structures

-

Enhanced faceless assessment mechanisms

-

Better grievance redressal timelines

Small changes, big comfort.

Budget 2026 PDF Download

The official Budget 2026 PDF can be downloaded from the Government of India’s budget portal. It includes:

-

Finance Bill 2026

-

Budget speech

-

Explanatory memorandums

-

Annexures and notifications

A must-read if you love details.

Indirect Taxes Changes

GST – Structural Tightening Without Rate Noise

No GST rate hikes. No rate cuts. And yet—GST changes matter.

Budget 2026 focuses on:

-

Stronger invoice matching

-

Reduced fake credit claims

-

Better data analytics

-

Tighter registration norms

In short:

Same rates, stronger system.

This approach avoids inflationary shocks while improving revenue efficiency.

Impact of Budget 2026 on Individuals

For individuals, Budget 2026 brings:

-

More time to file returns

-

Less procedural anxiety

-

Clearer investment taxation

-

Reduced compliance friction

It’s not a giveaway budget—but it’s definitely a relief budget.

Impact of Budget 2026 on Businesses and Startups

Businesses benefit from:

-

Simplified TDS/TCS processes

-

GST compliance clarity

-

Stable tax environment

-

Encouragement for global expansion

Startups, in particular, gain confidence from policy continuity.

Impact on Foreign Investors and NRIs

Foreign investors and NRIs enjoy:

-

Tax holidays

-

IFSC benefits

-

Clearer disclosure rules

-

Improved ease of doing business

India is clearly saying: “We’re open, transparent, and stable.”

Conclusion

Budget 2026 may not trend on social media, but it wins where it counts—long-term stability, smoother compliance, and global credibility. It’s a budget that doesn’t shout but speaks confidently. For taxpayers, businesses, and investors alike, Budget 2026 builds trust through clarity rather than surprises.

Sometimes, the quiet budgets are the strongest ones.

FAQs on Budget 2026 Highlights

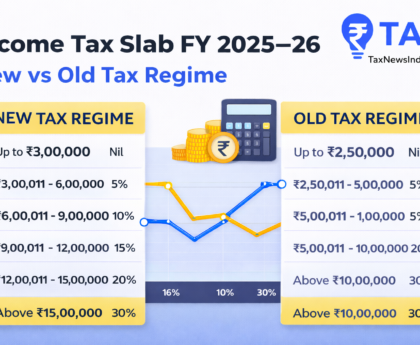

1. Is there any change in income tax slabs in Budget 2026?

No, Budget 2026 focuses on procedural improvements rather than slab rate changes.

2. Has the ITR filing due date been extended?

Yes, especially for non-audit taxpayers and revised returns.

3. Are GST rates changed in Budget 2026?

No GST rate changes, but compliance mechanisms have been strengthened.

4. What is the biggest benefit for small taxpayers?

Extended timelines and the foreign asset disclosure scheme.

5. Does Budget 2026 attract foreign investment?

Yes, through tax holidays, IFSC exemptions, and compliance clarity.