Saving income tax in FY 2025–26 requires smart planning, not last-minute March investments. Whether you are salaried, self-employed, freelancer, or business owner, structured tax planning can legally reduce your tax liability under the Income Tax Act, 1961.

This comprehensive checklist explains:

-

Old vs New Tax Regime comparison

-

Section-wise deductions

-

Salary optimization strategies

-

Capital gains planning

-

Business taxpayer benefits

-

Frequently asked tax questions

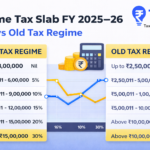

H2: Step 1 – Old vs New Tax Regime (Detailed Comparison)

Comparison Table

| Feature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Tax Rates | Higher | Lower |

| Deductions | Allowed (80C, 80D, HRA etc.) | Mostly Not Allowed |

| Suitable For | Investors & Loan Holders | Simple salary earners |

Example Calculation (₹10 Lakh Salary)

Case 1: Old Regime

-

80C: ₹1,50,000

-

80D: ₹25,000

-

Standard Deduction: ₹50,000

-

Total Deduction: ₹2,25,000

Taxable Income: ₹7,75,000

Case 2: New Regime

-

Standard Deduction (if applicable)

-

No 80C, 80D benefits

👉 Always calculate both before filing.

H2: Step 2 – Section 80C (₹1.5 Lakh Deduction)

Eligible Investments:

-

PPF

-

ELSS

-

EPF

-

Life Insurance

-

5-Year Tax Saving FD

-

NSC

-

Home Loan Principal

-

Children Tuition Fees

Strategy Tip: Invest monthly instead of March lump sum.

H2: Step 3 – Section 80D (Health Insurance)

| Category | Deduction |

|---|---|

| Self + Family | ₹25,000 |

| Parents < 60 | ₹25,000 |

| Parents > 60 | ₹50,000 |

| Senior Citizen Self | ₹50,000 |

Preventive check-up limit: ₹5,000

H2: Step 4 – Home Loan Benefits

-

Section 24(b): ₹2 lakh interest deduction

-

80C: Principal repayment

-

80EE/80EEA: Additional deduction

Tip: Maintain loan certificate properly.

H2: Step 5 – NPS (Extra ₹50,000 Deduction)

Section 80CCD(1B) allows additional ₹50,000 deduction beyond 80C.

This makes NPS one of the most powerful tax-saving tools.

H2: Step 6 – HRA & 80GG

HRA exemption depends on:

-

Basic salary

-

HRA received

-

Rent paid

-

City category

If no HRA → Section 80GG may apply.

H2: Step 7 – Education Loan (80E)

-

100% interest deduction

-

No upper limit

-

Available for 8 years

H2: Step 8 – Donations (80G)

-

50% or 100% deduction

-

Only via banking mode

H2: Step 9 – Capital Gains Planning

-

Section 54 (Reinvest in property)

-

Section 54EC (Capital Gain Bonds)

-

Loss harvesting strategy

H2: Step 10 – Business Taxpayer Checklist

If self-employed:

-

Claim business expenses

-

Depreciation

-

Professional tax

-

Home office expense

-

Section 44ADA presumptive scheme

H2: Common Mistakes to Avoid

-

Investing only for tax saving

-

Ignoring NPS

-

Not comparing regimes

-

No documentation

-

Last-minute investing

H2: FAQs (Add These)

Q1. Which tax regime is better for FY 2025–26?

Depends on deductions. Investors benefit from old regime.

Q2. Can I claim both 80C and 80CCD(1B)?

Yes. NPS ₹50,000 is additional.

Q3. What is maximum 80D limit?

Up to ₹1 lakh (with senior citizen parents).

Q4. Can business taxpayers claim 80C?

Yes, if opting for old regime.

Q5. Can I switch tax regime every year?

Salaried – Yes. Business income – Restricted.

Q6. Is NPS mandatory?

No, but beneficial.