The income tax slab for FY 2025–26 is one of the most searched topics in India, especially among salaried employees, freelancers, and small business owners. If you are confused about how much income tax you need to pay, this guide explains everything in simple English, with clear tables and practical examples.

What Is an Income Tax Slab?

An income tax slab is a predefined income range on which a specific tax rate is applied. India follows a progressive tax system, which means higher income is taxed at higher rates.

For FY 2025–26 (AY 2026–27), taxpayers can choose between:

-

New Tax Regime

-

Old Tax Regime

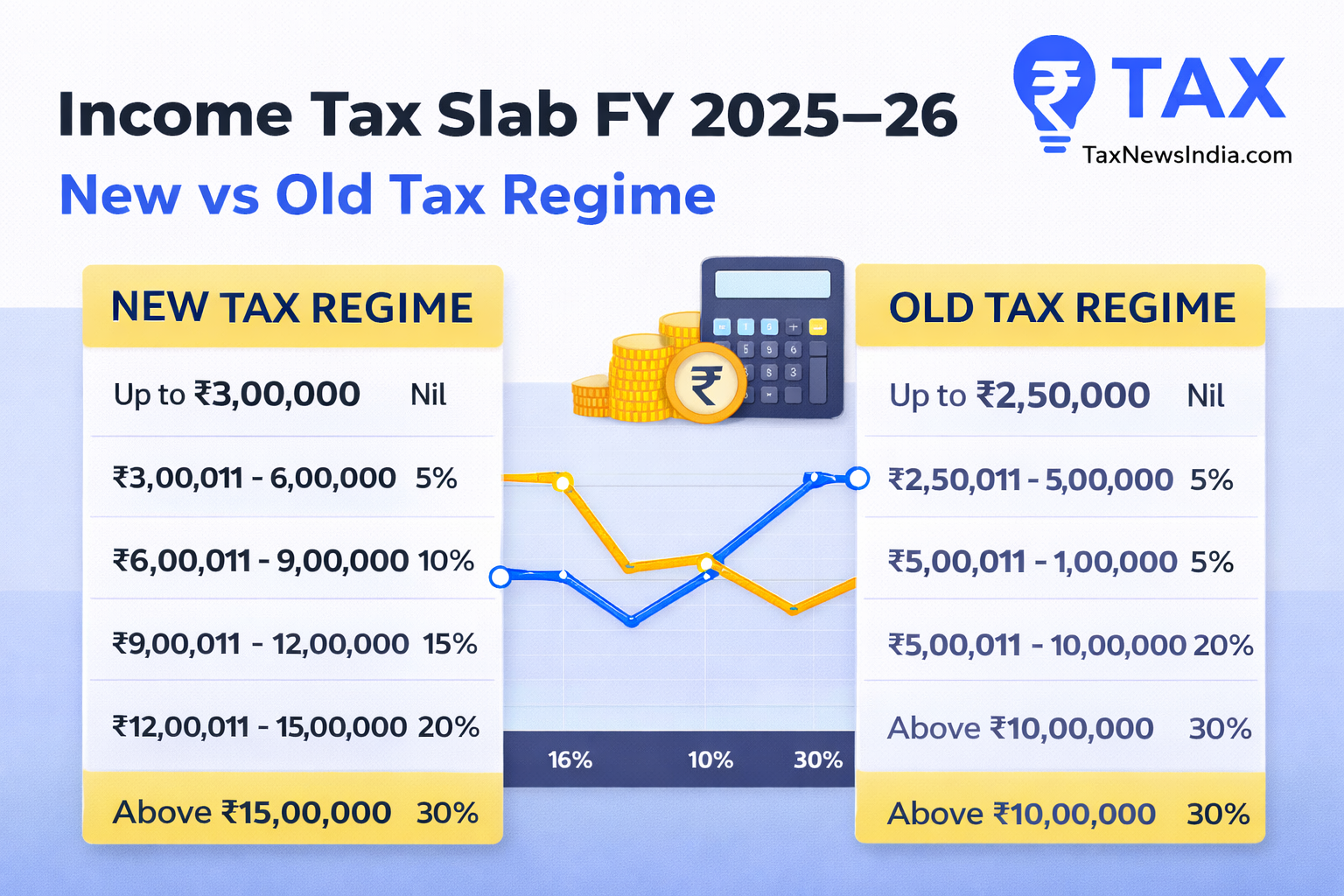

Income Tax Slab for FY 2025–26 – New Tax Regime

The new tax regime offers lower slab rates but limits most deductions and exemptions.

New Tax Regime Slab Rates (FY 2025–26)

| Income Range (₹) | Tax Rate |

|---|---|

| Up to 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

👉 Standard deduction of ₹50,000 is available for salaried individuals under the new tax regime.

Income Tax Slab for FY 2025–26 – Old Tax Regime

The old tax regime allows taxpayers to claim multiple deductions and exemptions, making it beneficial for those who actively invest in tax-saving options.

Old Tax Regime Slab Rates

| Income Range (₹) | Tax Rate |

|---|---|

| Up to 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

👉 Rebate under Section 87A may apply for eligible taxpayers.

Which Tax Regime Is Better for FY 2025–26?

The right tax regime depends on your income level and deductions.

Choose the New Tax Regime if:

-

You do not invest in tax-saving instruments

-

You prefer simple and hassle-free tax calculation

-

You have fewer exemptions

Choose the Old Tax Regime if:

-

You claim HRA

-

You invest under Section 80C

-

You pay health insurance premiums (80D)

-

You have a home loan

Income Tax Calculation Example (FY 2025–26)

Example:

Annual Income: ₹10,00,000

Standard Deduction: ₹50,000

Under New Tax Regime:

-

Taxable Income = ₹9,50,000

-

Approximate Tax = ₹67,500 (excluding cess)

Under Old Tax Regime (with deductions):

-

Section 80C = ₹1,50,000

-

Section 80D = ₹25,000

-

Taxable Income = ₹7,75,000

-

Tax Liability = Lower than new regime

Important Points to Remember

-

You must choose your tax regime while filing ITR

-

The selected regime cannot be changed later for that year

-

4% Health and Education Cess applies in both regimes

Frequently Asked Questions (FAQs)

Q1. Can I change my tax regime every year?

Yes, salaried taxpayers can choose a different regime every year.

Q2. Is the new tax regime mandatory?

No, it is completely optional.

Q3. Is standard deduction available in the new tax regime?

Yes, ₹50,000 standard deduction is allowed.

Q4. Which tax regime is better for salaried employees?

The old regime is better if you claim multiple deductions; otherwise, the new regime may be beneficial.

Conclusion

Understanding the income tax slab for FY 2025–26 allows you to plan your finances better and reduce your tax burden legally. Always compare both tax regimes before filing your return to maximize savings.